Market approach is the use of observable prices arising from 1) similar publicly traded companies or 2) transactions involving similar businesses / assets. It is common in estimating value of going concerns. (If there is available and relevant data out there, it is very straightforward.)

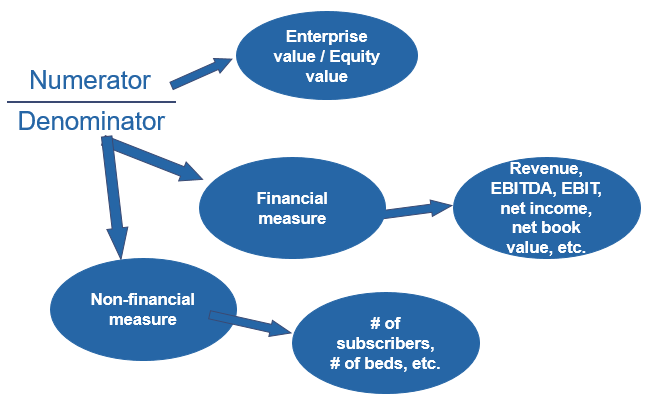

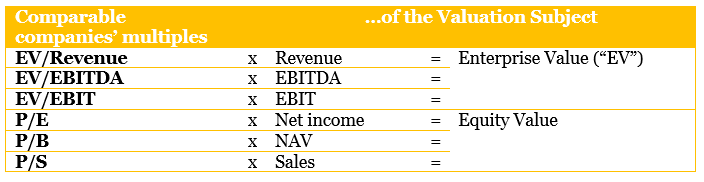

Illustrating the formation of multiples:

Note: Please refer to our other section for details in connection with the EV and Equity Value.

A distinguishing fact about the difference between EV and equity value is that, EV multiples (the first three) use financial data before debt services, while Equity Value multiples use financial data after debt services. It is all about matching the numerator and the denominator.

So if you would like to estimate the value of a company (using the market approach) without having the multiples being distorted by comparable companies’ gearing level (or debt-to-capital structure), i.e. a company with relatively higher portion of interest is likely going to having a lower P/E, you tend to go for the first three multiples.

It is then easy to follow that, for EV/EBITDA, in addition to the previously mentioned gearing level, we avoid comparing companies with considerably different depreciation and amortisation (“D&A”) pattern. EBITDA is commonly known as the proxy for a company’s operating cash flow (you should agree as D&A is a non-cash item), so it is a more commonly used multiple.

EV/EBIT is similar to EV/EBITDA except that it considers the D&A pattern. It is worth noting that the EBIT could be way lower than the EBITDA for companies in a capital intensive industry.

EV/Sales is common for start-up (i.e. early stage tech co.) when the company is loss-making at both EBIT and EBITDA level, although firms with identical revenue may have widely different margins.

The multiples start with (P)rice help to derive the Equity Value. P/E is used to calculate the Equity Value as earnings are only attributable to equity holder. Trading price is the numerator and the earnings per share is the denominator. Certain technical aspect of the P/E multiple: 1) normalising the earnings to ensure we are comparing apple-to-apple, and 2) the use of forward (forecast / leading) earnings are preferred as they are forward looking and incorporate market expectation. P/E is easy to use and widely accepted, but it may not be relevant for high growth companies (i.e. volatile earnings) / companies with negative earnings / subject to accounting distortion.

P/B reflects a comparison of the book and market value of companies’ equity. Surplus assets / liabilities should not be included (back to the apple-to-apple concept). Fun fact, P/B is commonly used for valuing banks, as banks hold mostly liquid assets (thus book value approximate fair value). Book value is usually positive and more stable than earnings, which makes P/B an attractive multiple. However, it does not reflect value of intangible assets (i.e. intangible assets that could be identified via a purchase price allocation such as customer relationships or trademark). Also it could be subject to accounting distortion.

P/S is similar to EV/Sales except that it gives Equity Value. It is always positive (I bet you have never seen negative revenue in any financial statements!) and not as easy to game (i.e. accounting manipulation could distort earnings).

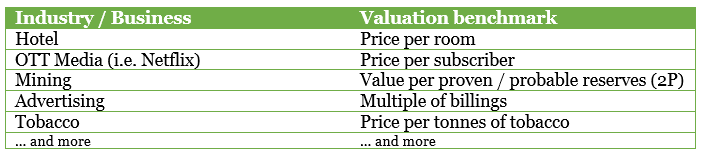

For non-financial measure, it is just the same concept and some examples illustrate below:

Come to us again for more details related to transactions involving similar assets / business.