Introduction

When a business is acquired, we have to allocate the consideration into the target’s assets and liabilities and the residual amount would be the goodwill. (If you want to know more about the allocation, please refer to our other section “How to do purchase price allocation?”) The goodwill has no finite life and therefore one would need to test for this asset every year or when there is an indicator that the business is not doing alright (you can’t leave it unchanged if the asset’s recoverability is free-falling!)

In this article, we will focus on valuation (but some accounting terms might pop up, do come to us if you have any inquiries). In most cases we will have to do an approximation of the business’ value using a present value techniques called the discounted cash flow (“DCF”) to arrive the free cash flow to firm (“FCFF”). (Details of the DCF technique covered in our other section “How to do a business valuation?” and we will share with you more in the other section “FCFF vs FCFE”) It is commonly known as the income approach. (For other valuation approaches, please go to “The valuation approaches” for more details.)

Our focus here is related to the IFRS but not GAAP.

The “Why?”

Why do we have to perform an impairment assessment? As mentioned, we have to measure the value of the business because there were intangible assets (i.e. goodwill) with an indefinite life, or there is a triggering event (or impairment indicator) indicating the economic benefits associated with an asset have dropped drastically (i.e. the rise of the subscribed TV industry is making the traditional TV’s advertisement business suffers).

At last, the impairment assessment is for financial reporting purpose, meaning that it is a must-do for annual review. Though, whenever triggering events occur that are likely to reduce the value of the business (or the recoverable amount, to be discussed later), an impairment test is mandatory and should be performed immediately.

External impairment indicator:

- Faster decline of the market value than would be expected as a result of the passage of time or normal use;

- Negative changes of technological, economic, legal and market environment;

- Increase in market interest rates or other market rates of return on investment; and

- Net assets exceed market capitalisation

Internal impairment indicator:

- Indication of the asset’s obsolescence or physical damage;

- Significant strategic or operational changes with an adverse effect on the enterprise have taken place during the period, or are expected to take place in the near future, in the extent to which, or manner in which, an asset is used or is expected to be used; and

- Performance worse than expected

The DCF

FCFF = EBIT (1 – t) + D&A – Capex – ∆NWC

The first part of a DCF is the financial projection, somewhat similar to a 5-year profit forecast, where line item goes from top to bottom (i.e. revenue to net profit), one of the differences here is that we have to convert the accounting profit into FCFF, in that we have to consider certain non-cash items (such as depreciation & amortisation “D&A”), changes in net working capital (“NWC”) (remember accounting is prepared on accrual basis not cash basis) and capital expenditures (“Capex”).

The second part is to arrive a present value (“PV”) using the discount rate, a.k.a. weighted average cost of capital (“WACC”). (Details of how we estimate a WACC is covered in “How to calculate WACC?”) The other key parameter would be the long-term growth rate where people adopt it for the terminal year calculation (obviously we don’t want to miss out the terminal value calculation as it contributes a huge chunk of value!) Having considered the above, we arrive the PV of FCFF (we are close to getting the results, but how can we tell if there is an impairment?)

Carrying Amount (“CA”) vs Recoverable Amount (“RA”)

The answer of the previous question is that when RA is greater than CA, there is no impairment and vice versa.

The thing is, how do we determine the CA? The simplest answer we could give you is that, group the property, plant and equipment (“PPE”), intangible assets (“IA”) and goodwill together and this is your CA, the assets together is commonly known as the cash-generating unit (“CGU”) (A friendly reminder – you have to make sure these items are operating in nature, for instance, a machinery is one for a manufacturing business but a club membership is not. Another reminder is that you may allocated the fair share of corporate assets or attributable liabilities where applicable.) What about RA? To put it shortly, RA is the PV of FCFF we calculated using the DCF.

Fair Value Less Cost of Disposal (“FVLCOD”) vs Value-in-use (“VIU”)

These are the basis of value. We have to ensure that the basis of the financial projection is consistent with the basis of value.

The best evidence of FVLCOD is an arm’s length transaction less disposal cost. It is then the market price less cost of disposal comes second. At last, it is the best information available to reflect amount a company could obtain, this is essentially the PV of FCFF calculated.

VIU, as the name suggests, reflects how the market would price the cash flows that management expects to derive from (using) the assets. This, again, is simply the PV of FCFF calculated.

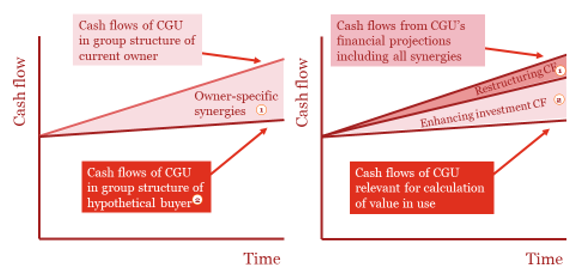

So, what are the actual differences between the two when we are preparing for the financial projection? Basically, if the VIU basis is adopted, the financial projections should not have considered any uncommitted restructuring, etc. (the chart on the right below) On the other hand, if the FVLCOD basis is adopted, any company specific synergies should be excluded from the financial projections, etc. (the chart on the left below)

You could choose either FVLCOD or VIU as the basis for the financial projection. Though, according to the standard, the RA is the higher of FVLCOD or VIU. So, say the RA – FVLCOD is lower than the CA, you might want to check if the RA – VIU is higher than the CA such that there will be no impairment.

In practice, the definition of a hypothetical buyer (or a market participant) as well as estimating the amount of owner-specific synergies is challenging.

CGU vs Individual asset

The RA is determined for an individual asset, unless the asset does not generate cash inflows that are largely independent of those from other assets or groups of assets. If this is the case, RA is determined for the CGU to which the asset belongs.

The RA of an individual asset cannot be determined if:

(a) the asset’s VIU cannot be estimated to be close to its FVLCOD (for instance, when the future cash flows from continuing use of the asset cannot be estimated to be negligible); and

(b) the asset does not generate cash inflows that are largely independent of those from other assets. In such cases, VIU and, therefore, RA, can be determined only for the asset’s CGU.

We will illustrate the above with the following example:

A mining company owns a private railway to support its mining activities. The private railway could be sold only for scrap value and it does not generate cash inflows that are largely independent of the cash inflows from the other assets of the mine. It is not possible to estimate the RA of the private railway because its VIU cannot be determined and is probably different from scrap value. Therefore, the entity estimates the RA of the CGU to which the private railway belongs, i.e. the mine as a whole.

Pre-tax discount rate (WACC)

The standard requires the application of a pre-tax discount rate (to discount the pre-tax cash flow for VIU). The problem is, how do we get the pre-tax discount rate? (Obviously it is not so difficult to obtain the pre-tax cash flow as we could simply have that by not considering any tax)

The answer is no, we will still use the post-tax discount rate to discount the post-tax cash flow in order to arrive the PV of FCFF. We then estimate the pre-tax discount rate through an iteration process (using the excel goal seek function, check out our video).

Accounting treatment of impairment losses

Impairment losses is recognised when an asset’s RA is lower than its CA.

Initial recognition of impairment losses involves:

- No reduction of individual assets below the highest of (a) the asset’s fair value less costs of disposal, (b) the asset’s value in use and (c) zero;

- Remaining losses recognised directly in income statement; and

- Amendment of depreciation or amortisation charge

Impairment losses reversed:

- Only where estimates have changed;

- Up to carrying amount had no impairment been charged (When assets have been impaired, a reversal is only allowed, if the underlying estimates for the determination of the recoverable amount have changed. Any reversal shall never lead to a higher carrying amount than the asset would have, had no impairment been charged for this asset.); and

- No reversal of goodwill impairment, ever!

Key practical issues with the goodwill impairment

1. CA calculated from the net asset value (“NAV”)

First of all, we have suggested a more efficient way in calculating the CA (by simply adding up the directly attributable assets and allocated goodwill) and we hope that you would use it. However, certain practitioners prefer to derive the CA from the NAV (by making adjustments from the equity value in order to come up with the CA).

We should agree that NAV is the equity value of a company and that the equity value consists of a company’s assets and liabilities. From an accounting perspective, the equity value = assets – liabilities. In order to convert the NAV into CA, one have to deduct the non-operating assets and add back the non-operating liabilities, which is consistent with the idea of keeping the items that are operating in nature when calculating the CA. As you can see, this is some troublesome calculations.

2. Whether or not to include the NWC in the calculation of CA

Believe it or not, this is one of the biggest controversies on goodwill impairment. The answer is that you could include or not to include the NWC, the key is to make sure you are comparable the CA and RA apple-to-apple. We will illustrate this with two scenarios below:

In the first scenario, you do not include the NWC (and therefore resulting a lower CA provided that you have a positive NWC), then you will have to include the NWC required during the first year of financial projection (assuming it is calculated as % of NWC – say 20% of revenue), which is relatively larger than as if you were to include the change of NWC between years. As such, this results into a lower RA.

In the second scenario, you include the NWC (and therefore resulting a higher CA provided that you have a positive NWC), then you will only have to include the change in NWC between the base year (i.e. 31 December 2018) and the first year of projection (i.e. from 1 January 2019 – 31 December 2019). As such, this results into a relatively higher RA compared to the first scenario.

This is consistent with the idea of comparing CA and RA on an apple-to-apple basis. With a lower CA (not to include the NWC) it comes with a lower RA, and vice versa.

3. Can Capex be included in the VIU calculation?

Capex to expand business?

No.

Capex to repair or replace?

Yes, but they do not increase the capacity or improve the functionality.

Capex to reinvest business processes?

Yes, only if they are a committed plan and do not increase the capacity or improve the functionality.

Capex that is maintenance in nature?

Yes.

The relevant accounting standards are indicated below:

Future cash flows shall be estimated for the asset in its current condition. Estimates of future cash flows shall not include estimated future cash inflows or outflows that are expected to arise from:

- a future restructuring to which an entity is not yet committed; or

- improving or enhancing the asset’s performance.

Because future cash flows are estimated for the asset in its current condition, VIU does not reflect:

(a) future cash outflows or related cost savings (for example reductions in staff costs) or benefits that are expected to arise from a future restructuring to which an entity is not yet committed; or

(b) future cash outflows that will improve or enhance the asset’s performance or the related cash inflows that are expected to arise from such outflows.

Two additional questions you may ask in this regard.

What about FVLCOD calculation?

You can include the Capex we mentioned above.

Well then, provided that Capex is invested on the basis that it provides a positive net present value, it is reasonable to expect that the FCFF would be higher relative to the VIU calculation. It follows that the FVLCOD tends to provide a relatively higher value, and that the RA is the higher of FVLCOD or VIU, one should always go for FVLCOD, isn’t it?

Not necessarily true, first, the FVLCOD calculation is subject to discount for lack of marketability (“DLOM”); and second, the business synergies (positive to FCFF in most case) are not considered under FVLCOD calculation.

4. Almost-nil-cost synergies

As mentioned, owner-specific synergies shall only be included in the VIU calculation.

The author has come across with the below during a review of an impairment assessment prepared on VIU basis. After reviewing the financial projections, the author observed that the rental expenses assumed are not at arm’s length (and they are way below the market rent). The client advised that this is one of the synergies the CGU is entitled as the group has idle space and is willing to rent it to the CGU at a ridiculously low price (you can picture an almost-nil-rent under this scenario), the rental agreements were also provided to the author.

At some points this seems to be valid under the VIU calculation, isn’t it? But then we might end up losing the purpose if we could lower all the costs by any means necessary – we will never have an impairment and this is great!

The author could think of a counter-argument particular for this case. If such benefits (cost synergies) are considered in the calculation of RA, shouldn’t the corporate assets (renting at a favourable rate) be included in the calculation of CA as well?

My final word is that, always think apple-to-apple!

5. Do we have to prepare two set of financial projections (for VIU calculation and FVLCOD calculation respectively)?

The business plans (or financial projections) can be expected to include a certain amount of owner-specific synergies, which would have to be excluded in order to represent the set of fair value assumptions and, consequently, the cash flow projections of a market participant, for FVLCOD calculation.

Applying the set of assumptions of the market participant in order to adjust the original cash flow projections to the cash flows a market participant would project (and pay for), is essential for the fair value concept.

However, the main problem of the fair value concept with regard to CGUs or groups of CGUs is to determine the correct set of assumptions of the market participant (e.g. which amount of synergies are owner-specific and which amount could be realized by every market participant). This is usually very difficult and often not feasible in practice.

In order to take the company’s business plan (potentially including owner-specific synergies) as the basis for the fair value determination, it has to be pointed out clearly that these synergies are comparable to the expected synergies of an average market participant.

The suggested solution for this is to state that the business plan used is identical to the business plan of the average market participant and actually no owner-specific synergies exist. Under this circumstance, you may not need to prepare for two set of projections tailored for VIU and FVLCOD calculations.

In reality, in case that the RA is higher than the CA under one of the calculations (VIU / FVLCOD), you actually do not need to consider whether the other calculation would provide a higher value as the key to an impairment assessment is to conclude that there is no impairment.

6. What is apple-to-apple comparison?

I think this is pretty well-covered in the above example. I will just leave you with two apples.

7. What is the sequence of applying the impairment loss for a CGU?

The impairment loss shall be allocated to reduce the CA of the assets of the unit (group of units, or CGU) in the following order:

(a) first, to reduce the CA of any goodwill allocated to the CGU; and

(b) then, to the other assets of the unit (group of units) pro-rata on the basis of the CA of each asset in the unit (group of units).

8. High-level cross-check is essential

Say there is an acquisition during last year (and it is usually the case that the acquisition date valuation of the target is provided). It is useful to make reference to this prior year valuation to gain comfort on the current year valuation for the impairment assessment calculation. This could include comparing the discount rates and financial projections (day 1 versus as of now).